-

Industries

- Banking & Financial Services

- Insurance

- Manufacturing

- Government & Public Sector

- Healthcare

- Retail

- Telecom

-

Services

-

Solutions

-

Discover Us

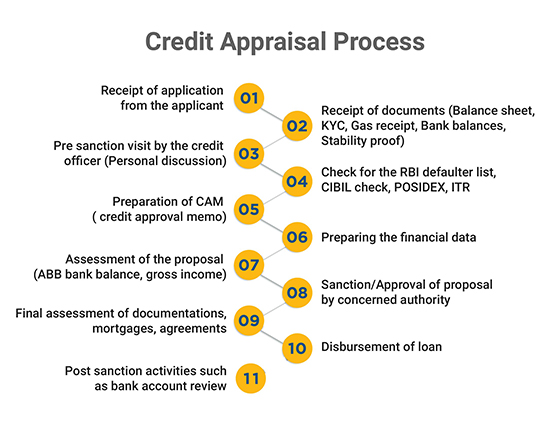

- Customer On boarding – Digital or Physical

- KYC validation and Verification

- Data Processing

- CAM preparation (Credit Appraisal) and Case Preparation (Insurance)

- KYC Verification

- Financial Analysis and Plotting

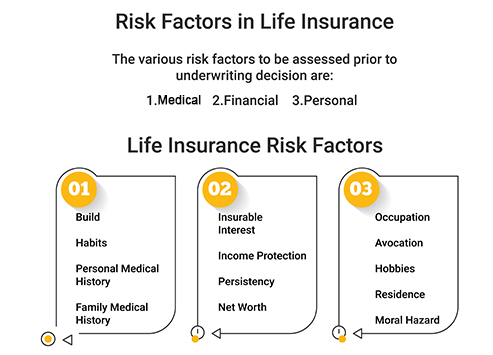

- Health Investigation (Insurance)

- Recommendation of Decision

- Tele Verification or Tele Underwriting

- Field Investigation – Demographics, Employer and Social

- Post Sanction Document Collection – Agreements, NACH

- Non Discrepancy Check – Post Sanction Scrutiny

- Disbursement

- Secured Storage – Physical or Digital (Cloud)

- Traceability of information among the transaction associates

- Setting up of a baseline when it comes to assessing performances of the people involved

- Effectiveness of a given intervention to cut down on negative impacts

- Boosting the purchasing powers of the customers

- Helping companies take a proactive approach

- Review credit histories with increased precision

- Qualify consumers by predicting their behavior pattern

- Reduce Operating Costs

- Improve Efficiency

- Transparency & Traceability in Lending Cycle

- Reduce Operational Risks

- Improve Customer Acquisition Process

- Systematisation of processes

- Consistency in cashflow analysis

- Standardisation in risk rating processes

- An effective workflow management

- Making use of security-first compliance approach

- Devising a risk monitoring workflow

-

Get technology-led domain expertise across multiple verticals

-

Gain from specialised transition management skills and solutions

-

Benefit from the only E2E data governance solution provider in India

-

Avail of a scalable value-chain with onboarding, servicing, and deboarding

-

Take advantage of best-in-class delivery capabilities across India, Middle East and Africa

-

Profit from process re-engineering emphasis on customer delight, risk reduction, and optimal servicing cost

Enquire Now

Credit Underwriting Process

We combine domain expertise, efficient tools and specialised technology

tools for an adept credit underwriting process.Writer Information's BPS team gives a complete and thorough credit underwriting service for multiple lending institutions.

Credit appraisal or Underwriting in a Bank, Financial Services or an Insurance company is a risk assessment process of appraising the creditworthiness of someone applying for a loan or an insurance policy. To assess the credibility of the borrower, his sources of income, age, experience, number of dependents, repayment capacity, past and existing loans/policies, health, nature of employment and other assets are taken into account.

We at Writer Information support credit assessment and Underwriting activities within BFSI by providing “End to End Life Cycle Management. This means from the first-mile pickup, processing to the last-mile storage we are a One Stop Shop for the customers, and this gives us a competitive advantage. The services that form a part of this end-to-end journey include:

Operational benefits

Transparency & Traceability

Rapid advances in technology help to collect, monitor, and disseminate information that have contributed towards the development of completely new modes of sustainability, when it comes to governance of the global commodity supply chains.

Benefits delivered:

Improve Customer Acquisition Process

It becomes convenient to predict consumer behaviour, build a strong customer base and develop the portfolio from there on.

Benefits delivered:

Reduce Operating Costs

Credit Underwriting integrates the client’s strategic business objectives by streamlining the credit processes. The operational benefits delivered include:

Improve Efficiency

Credit underwriting as a tool helps to improve the overall efficiency of credit risk management in the volatile financial domain.

Reduce Operational Risks

Managing risks is a major concern when it comes to financial services industry of all sizes. This is where proper implementation of all possible financial intermediation comes into the picture. This can be achieved through:

Our Value Differentiators

Insights

BPM automation for digital transformation

Read More

Best Practices for Securing Sensitive Data in Financial Services

Read More

Writer Information Business Process Services

Download BrochureDevising intelligent technology solutions and growth strategies to help data-driven businesses

Talk to an Information Expert today!

to scale up and evolve faster than the market.

- Industries

- Services

- Solutions

- Discover Us

- Knowledge Hub

- Contact Us Plot No. 105, Dr. Babasaheb Ambedkar Road, Lalbaug Mumbai – 400 033